Never miss Submitting a Report with Reminders Feature

Look! An unsubmitted expense report!

Are you someone who often forgets to submit expense reports on time? Worry not, Gorilla Expense has got you covered.

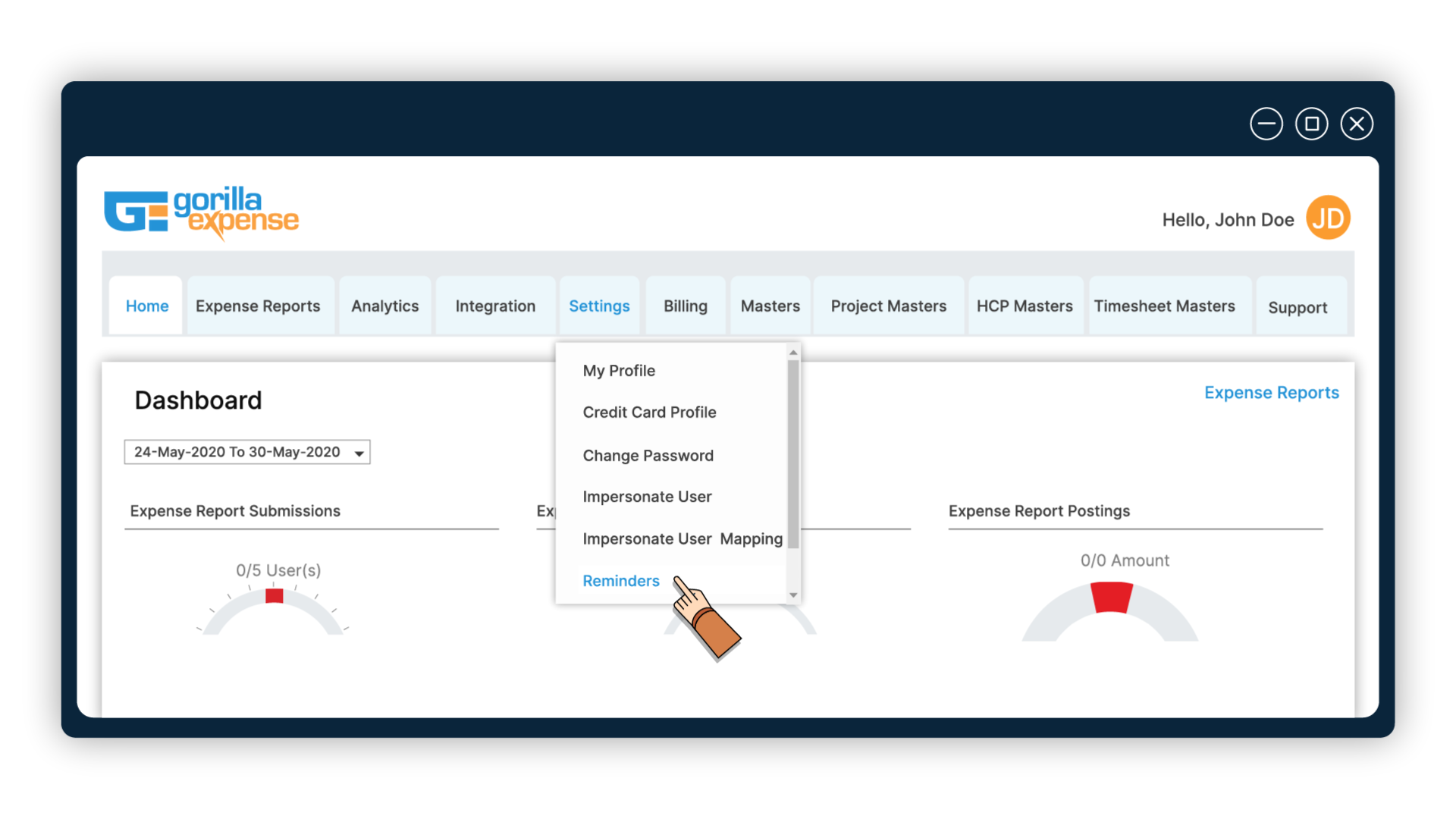

Adding to its list of advanced features Gorilla Expense brings another simple, yet powerful ‘Reminders’ feature. A feature that proactively alerts you when expense reports are due, keeping your team accountable and helping you maintain an accurate expense record.

Based on the business needs, there are 5 types of reminders:

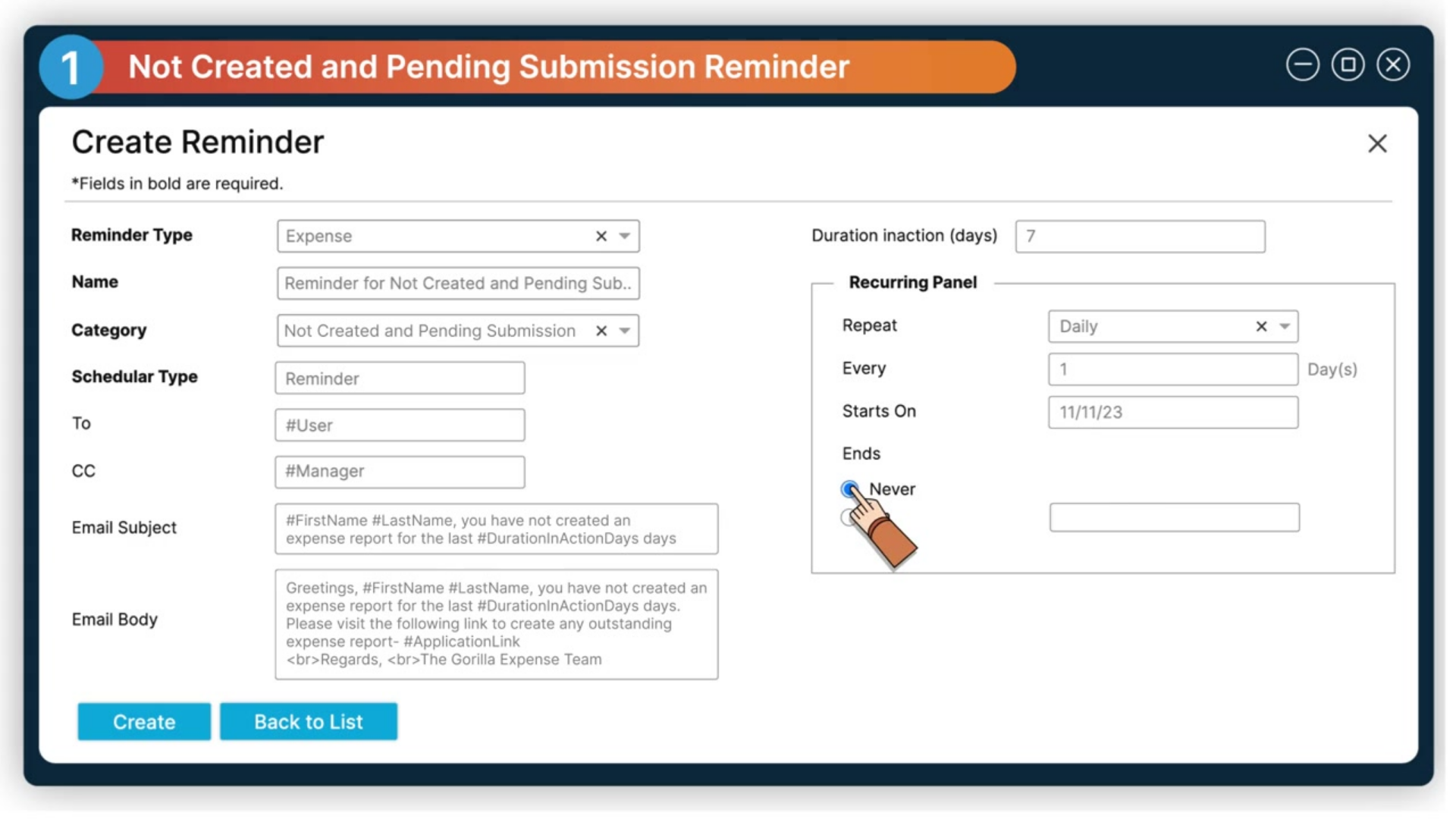

- Not Created and Pending Submission Reminder: This reminds end-users to create and submit an expense report at least once during a predefined time period (weekly, bi-monthly, monthly)

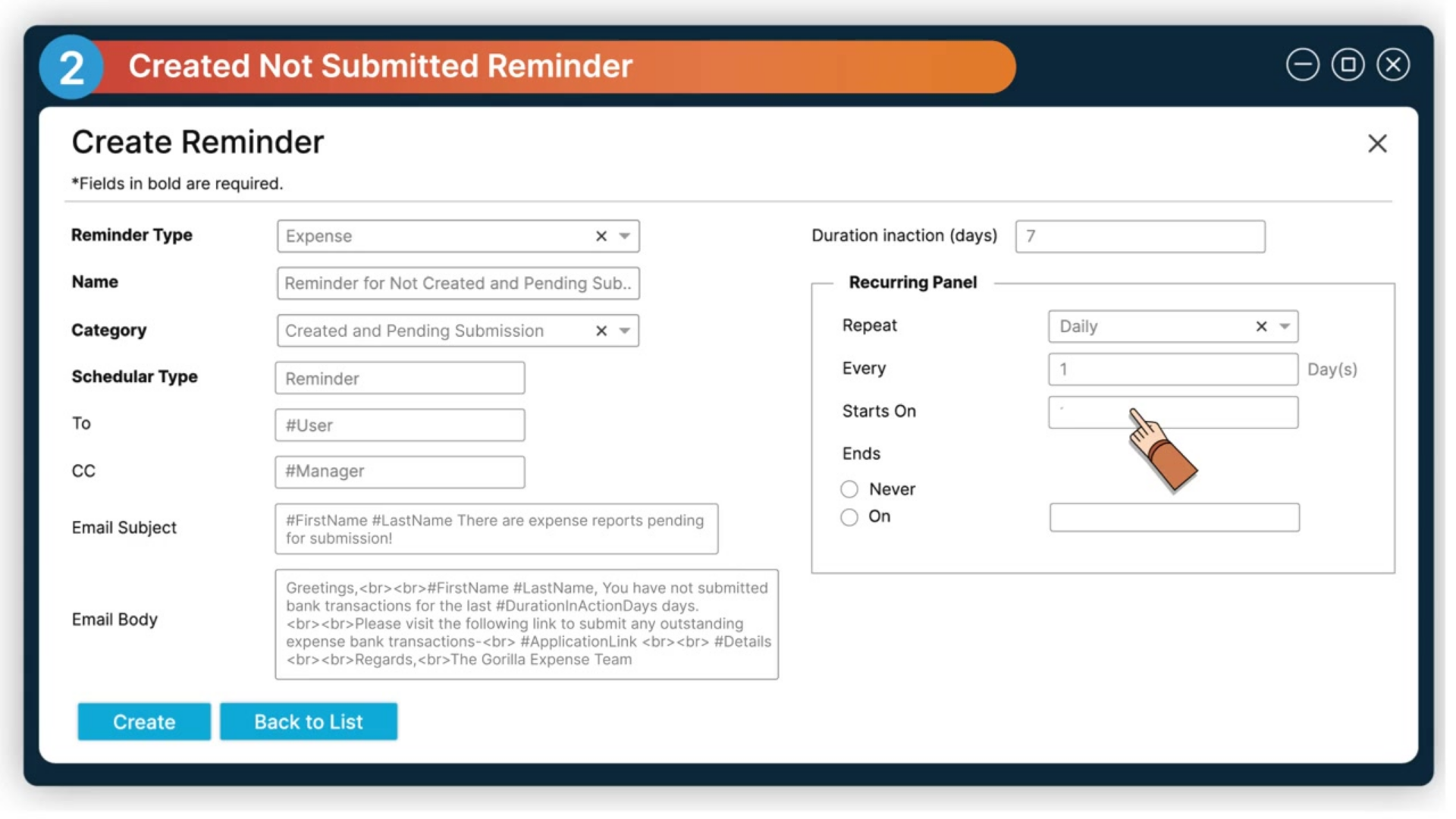

- Created Not Submitted Reminder: If you are someone who creates the reports but forgets to submit them, then this will remind you to submit your expense reports that have been collecting dust for a long time now.

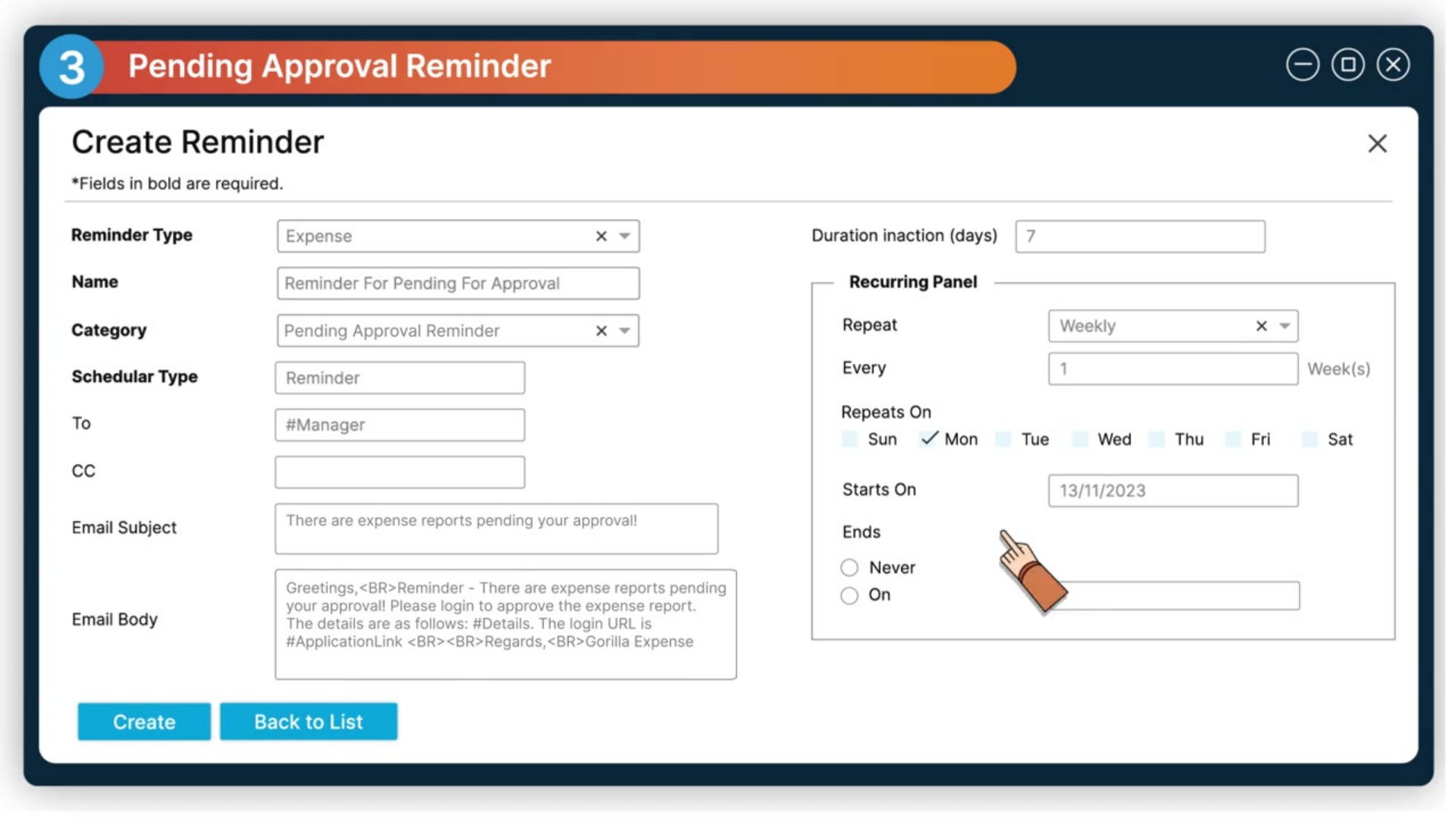

- Pending Approval Reminder: To the managers who have been sitting on the approval requests, this reminder will nudge you till you process all those pending approvals.

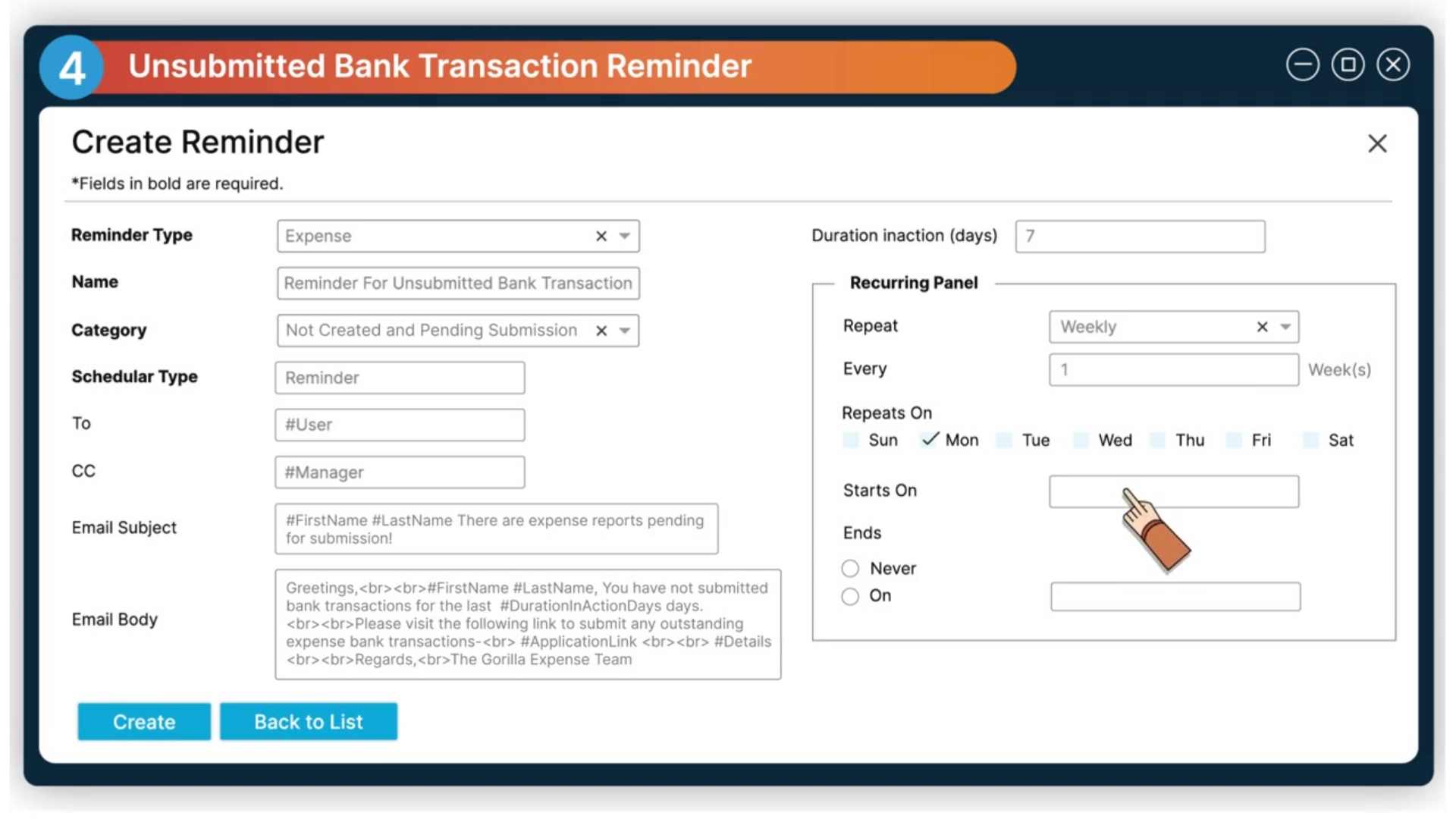

- Unsubmitted Bank Transaction Reminder: It will remind end-users to complete those credit card transactions and assign them to a report before it is too late.

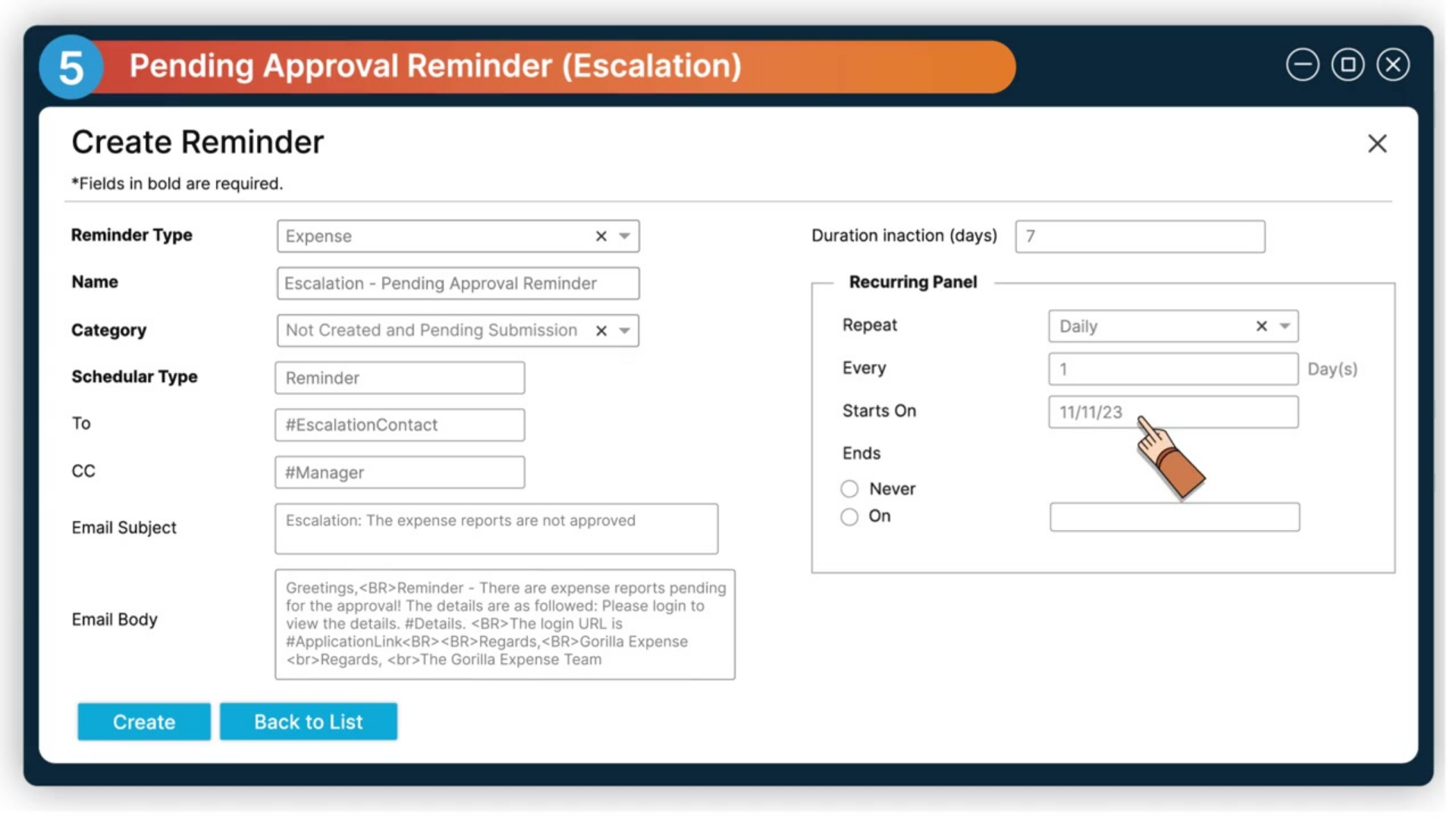

- Pending Approval Reminder (Escalation): Designed for managers who take forever to approve expenses. This will escalate the approval request through the right channels, ensuring the reports get approved and the situation escalates.

Select either of the categories and watch how it would prevent backlogs, ensure timely approvals, eliminate discrepancies, and resolve approval delays.

If you want to understand this feature in detail, then click here.

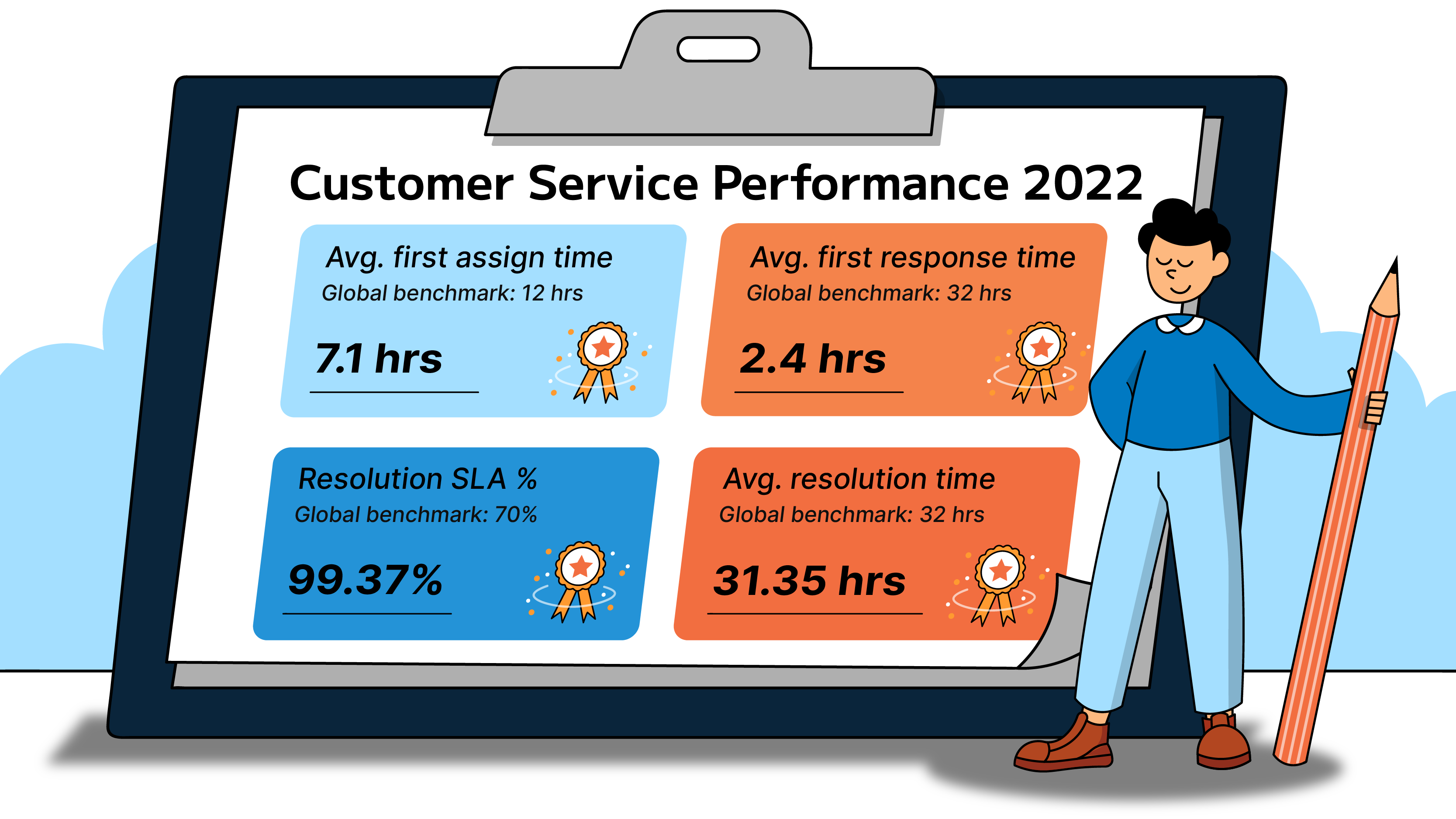

Gorilla Expense has been working tirelessly to provide you with the best-in-class, and hassle-free features that make your expense management process easy like a breeze.

To know more about the features click here.